KC-CUR 2019 Small Business Opportunity Survey

In 2019, as part of our work in building outreach and developing programs to prioritize and improve capital access for women- and minority-owned business enterprises (W/MBEs), KC-CUR partners UNI and LISC engaged a consultant team led by Eastside Collaborative to build a base of empirical information about economic activity within the UNI service area and KC-CUR Priority Areas.

Scope of Work

The consultant scope of work for the project included:

- Commercial market profiles for each KC-CUR Priority Area (links provided below);

- A detailed inventory of existing W/MBEs (including W/MBEs that have not pursued formal local, state or federal designation as such) within the larger UNI service area;

- Outreach to W/MBEs to identify unmet capital needs and barriers to accessing capital, as well as awareness of and challenges to navigating the local business/entrepreneurial support network;

- Identification of other major barriers W/MBEs face in establishing or growing their business;

- Recommended strategies and best practices for LISC and UNI to refer and support businesses through the established local entrepreneurial support network.

Major Findings

Eastside Collaborative identified a total of 537 home-based and brick and mortar businesses in the UNI service area. Eastside Collaborative determined that 27% of those businesses are minority-owned, 13% are woman-owned, and 10% are both women- and minority-owned.

- 60% of W/MBEs surveyed within the UNI area have been in business 5 or more years.

- Nearly 2/3 of these businesses are in service industry sectors.

- Most UNI W/MBEs surveyed are microenterprises: nearly 60% of respondents reported 2018 revenues of less than $100,000.

- While a majority of W/MBEs surveyed had accessed entrepreneurial support organization (ESO) services within the past two years, nearly half (46%) had not.

- 81% of responding W/MBEs have not pursued formal W/MBE certification. Most explained that they did not see a value in W/MBE certification for their business, or did not understand the benefits or process.

- 40% of W/MBEs need capital to rent, purchase or modify real estate for their business, and 39% would use new equity investment to hire additional staff.

- 51% of W/MBEs were most interested in a short-term line of credit¸ and many respondents expressed interest in learning more about available finance tools or direct assistance with seeking or qualifying for loans or equity investments.

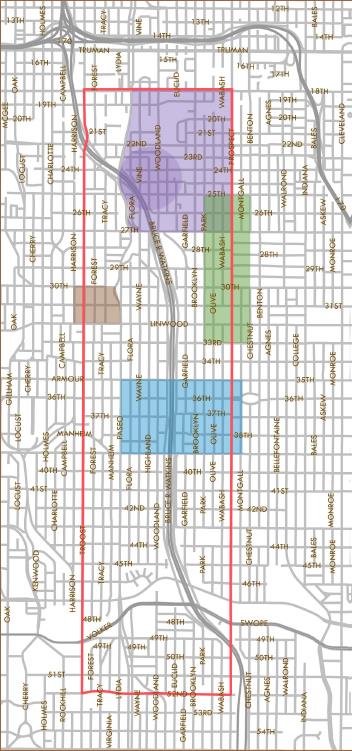

KC-CUR Commercial Market Profiles

With input from LISC, UNI and other community partners, Eastside Collaborative developed Commercial Market Profiles for each KC-CUR Priority Area. PDFs of these profiles are available for download: