Statewide Relief Fund Serves as a Lifeline to Small Businesses in Massachusetts

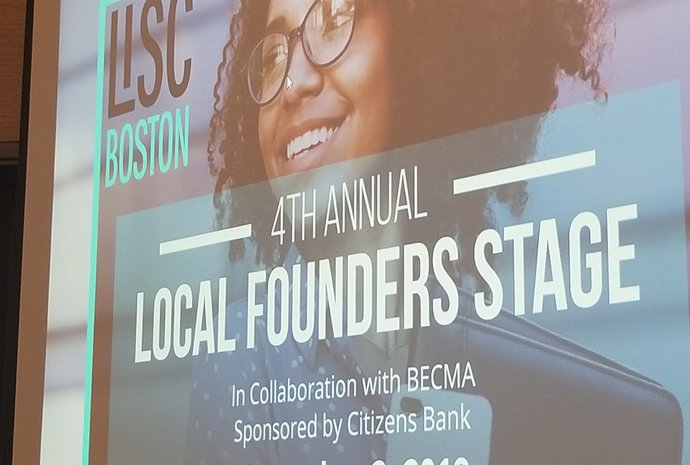

Local Initiatives Support Corporation (LISC) Boston announced today that 79 small businesses across the Commonwealth are receiving grants of up to $10,000 through the LISC Small Business Recovery Grant Program for Massachusetts. The program, launched with $400,000 in funding from Citizens Bank, provides grants to hard-hit small businesses to weather the immediate financial impact of the closures and position themselves for reopening.

“It is the small businesses who traditionally lack access to capital—especially minority and women-owned businesses—that have found access even more challenging during this crisis,” says Karen Kelleher, Executive Director of LISC Boston. “LISC therefore aimed to invest first-and-foremost in these and other businesses most at-risk in our response. LISC’s priority is always to invest in the resiliency of all of our communities and we saw this as yet another opportunity to prioritize equity.”

Read the stories of four small businesses selected to receive grants through the LISC Rapid Relief and Resiliency Fund for Massachusetts.

Grants were awarded to small businesses in almost every county in Massachusetts and will be mostly used to help cover payables and operating costs including rent, inventory, personal protective equipment (PPE), payroll expenses and benefits to support and retain employees. The program, which offered flexible grants of up to $10,000, was open to businesses with annual revenues of up to $1.5 million, but the vast majority of the over 3,700 applications came from businesses with revenues under $300,000 and with three or fewer employees. The applicants drew from a variety of industries, with heavy representation from the food, personal services, retail, professional services, and childcare sectors.

Citizens Bank’s $400,000 commitment is part of its $5 million commitment to fund communities and small business recovery across the bank’s service area.

“We know small businesses are important economic engines within the fabric of our communities,” says Jerry Sargent, President of Citizens Bank Massachusetts. “Supporting small business owners means supporting the neighborhood ecosystem and their employees as they deliver critical products and services to customers. Providing them with funds to manage through these challenging times is a lifeline we hope will have a big impact.”

The Small Business Recovery Grant Program is part of the LISC Rapid Relief & Resiliency Fund for Massachusetts which aims to provide emergency relief, critical technical assistance and longer-term recovery funding to help vulnerable businesses community-serving nonprofits weather the effects of the pandemic. For the Grant Program, LISC provided application questions in nine languages and conducted extensive outreach with nonprofit partners serving minority-owned small businesses across the state. Through the broader Rapid Relief & Resiliency initiative, LISC also facilitates technical assistance for equitable access to the federal Paycheck Protection Program (PPP) and the Beyond Six-Feet-Apart program as it invests and builds solutions with technical assistance providers.

Small business grantees across the Commonwealth include GreenLove Eco Cleaning of Northampton, 4 Corners Yoga + Wellness of Dorchester in the Boston area, Big Waves of Cambridge, and Kingdom Prints Co. of Lawrence.

For more on the LISC Rapid Relief and Resiliency Fund initiatives for Massachusetts, visit https://www.lisc.org/boston/covid-19. To donate to the Fund, visit www.lisc.org/Boston/donate.

Pictured above: Amy Lovell of GreenLove Eco Cleaning and her team. GreenLove Eco Cleaning is located in Northampton, MA and is one of the LISC Small Business Recovery Grant Program's grant recipients.

Find the latest initiatives from LISC Boston for Massachussetts' small businesses and communities.

The recovery grant program seeded by Citizens Bank provides relief to businesses across Massachusetts.