Community Investment Tax Credit

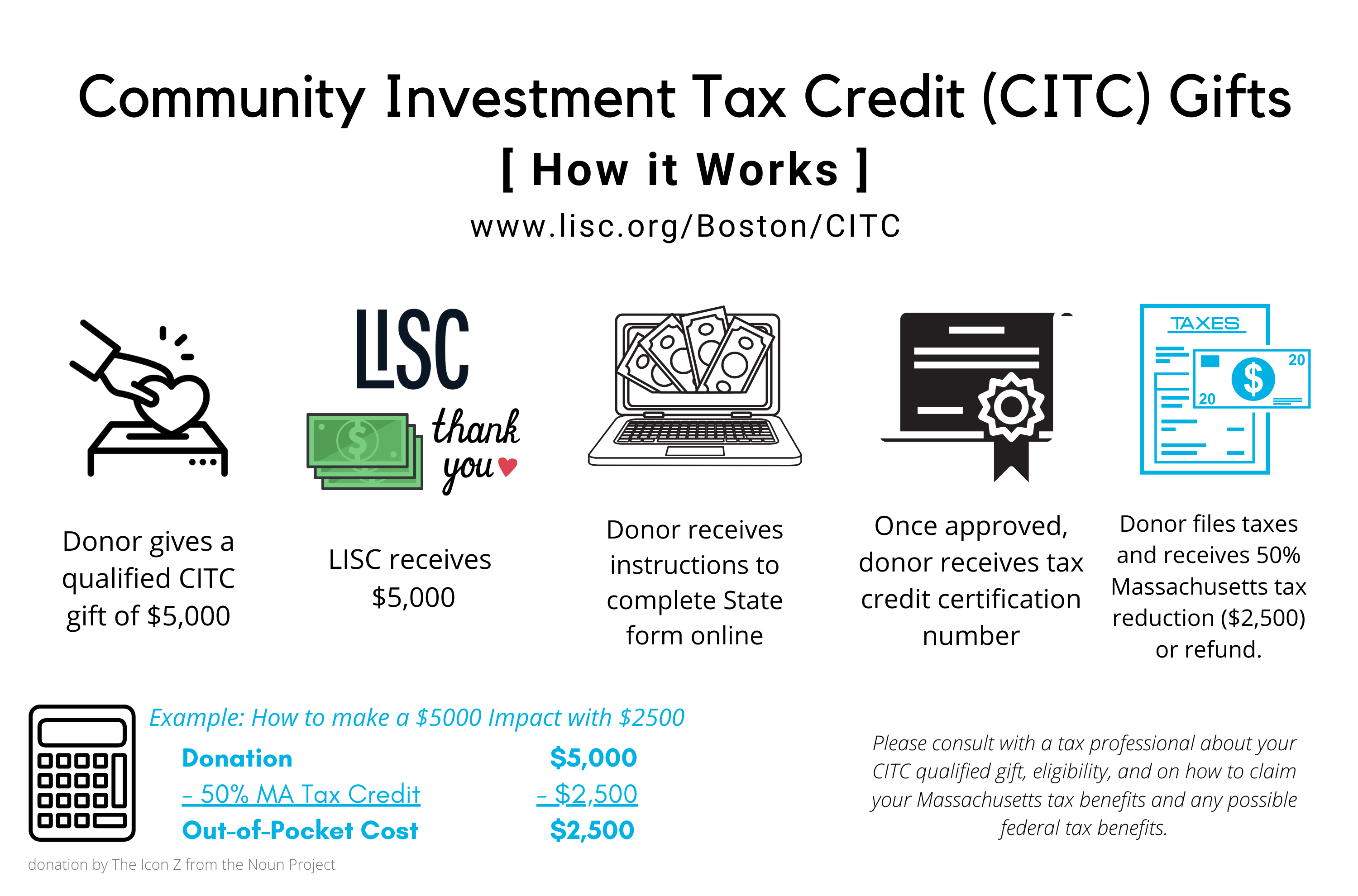

The Massachusetts Community Investment Tax Credit (CITC) provides a 50% refundable tax credit against Commonwealth of Massachusetts tax liability on donations over $1,000 - doubling the impact of your generosity!

Donate now to help fuel out work and impact in communities across Massachusetts.

Key Details:

▪ The minimum donation is $1,000

▪ Individuals, for-profit entities, non-profit organizations, and foundations are all eligible*

▪ Massachusetts residency and tax liability are NOT required

*Please consult with a tax professional about your specific eligibility.

The Community Investment Tax Credit (CITC) was signed into law on August 6, 2012 as part of a larger economic development bill called An Act Relative to Infrastructure, Enhanced Competitiveness and Economic Growth in the Commonwealth. It is designed to support high-impact community-led economic development initiatives through a strategic, market-based approach that leverages private contributions and builds strong local partnerships. This program is used to support a broad array of community development efforts as determined in partnership with the local community. For more on the program's background and history, click here.

Learn the history of the program from our partners at MACDC, plus how it works for CDCs across Massachusetts and for Community Support Organizations like LISC, MACDC, and the United Way.

It's easy to do well by doing good. Contributions over $1,000 may qualify for a 50% refundable tax credit through the program. Contact LISC Massachusetts at 617.338.0411 or druiz@lisc.org to learn more about making a Community Investment Tax Credit gift. LISC is an IRS designated 501(c)(3) nonprofit.