LISC + Ally Financial Bring Financial Coaching to Fuel Homeownership and Entrepreneurship

Three years ago LISC launched a program with Ally Financial to integrate financial coaching into existing services for aspiring homeowners and entrepreneurs in four cities. The program, which wrapped up the fall of 2022, achieved strong results despite the health and economic challenges brought on by the pandemic. In this piece, we look back at what our collaboration with Ally has accomplished and share stories about its impact on people and communities.

Three years ago LISC got together with Ally Financial, a leading digital financial services company, to talk about what we could do, together, to help aspiring entrepreneurs and homeowners make their dreams a reality. We quickly realized that a powerful tool was missing from the existing services they receive on their journeys: one-on-one financial coaching.

An alternative to group-based financial education, financial coaching provides the ongoing, personalized direction and encouragement that people need to build credit and savings and access affordable capital – the common prerequisites to launching a business or buying a home. Over the past three years, a $3 million grant from Ally has enabled LISC to help fill this gap in services in four cities: Charlotte and Philadelphia, where we focused on aspiring homeowners, and Detroit and Jacksonville, where we prioritized budding entrepreneurs.

Drawing on our 15 years of experience with financial coaching, which is the heart of our Financial Opportunity Center® model, LISC provided funding, training, and guidance to help seven community partners across the four cities to integrate financial coaching into their existing homeownership and entrepreneurship services.

LISC and our partners made equity a program priority from the start. Eighty-four percent of the people who benefited from these enhanced services identified as Black, Indigenous, and people of color (BIPOC); 77 percent were women. The three-year program, which wrapped up the fall of 2022, achieved strong results and served nearly 4,000 people despite the health and economic challenges brought on by the pandemic, which disproportionately impacted BIPOC communities.

For our entrepreneurs:

- 450 received support accessing loans critical to keeping their businesses open during the difficult period of the pandemic

- 243 jobs created and 220 jobs retained

- 230 entrepreneurs built their financial health by creating spending plans and setting financial goals

- 60 built or improved their personal credit

For those working to own a home:

- 3,700 created action plans, began saving and worked with financial coaches to build housing stability and start their path to homeownership

- 1,229 built or improved credit

- 918 built long-term savings

- 220 bought homes

- 1,386 avoided foreclosure or eviction

The numbers do not tell the full impact of our collaboration with Ally. The true measure are the stories of the people who have bought homes or launched businesses during a very challenging time. We’d like you to meet some of them. Discover their stories below.

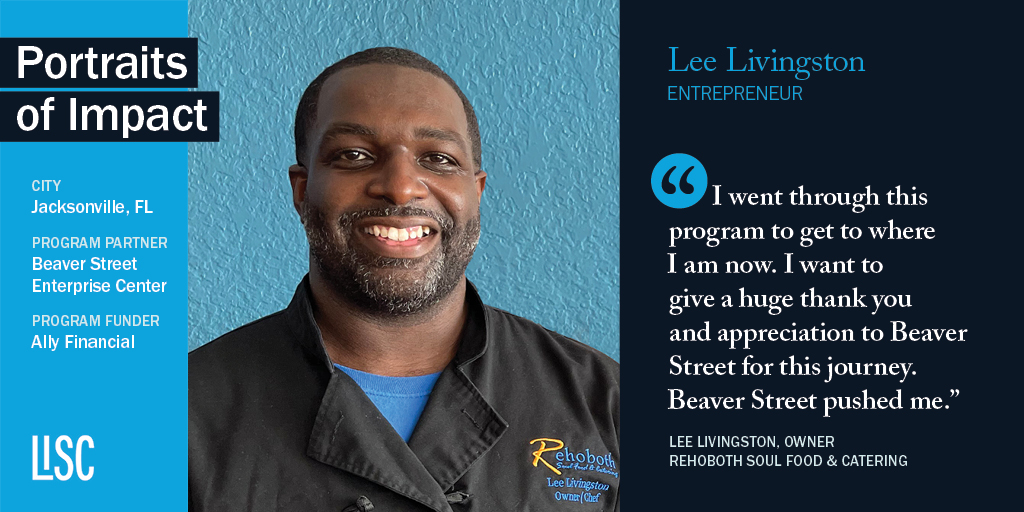

Lee Livingston, Jacksonville, FL