Manufactured housing, which 20 million Americans call home, is one of the few affordable housing options in the United States. The residents of two Washington State mobile home communities recently succeeded in purchasing their parks with help from ROC USA and over $2 million in financing from Rural LISC. As a result, they have been able to stabilize their housing costs, upgrade their communities and remain in the places they love.

A few years ago, Melanie Knight was ready to sell her manufactured home and move into an RV if she and her neighbors couldn’t band together to buy the park where their mobile homes sit from a negligent private owner. The community was in dire need of maintenance and updates, including fencing to keep drivers from running over the property’s septic field and lighting upgrades for the park’s poorly lit roads.

Knight had lived on and off at Quail Run Mobile Park in Moses Lake, Washington since 2003, and officially took over the family’s three-bedroom, two-bathroom home in 2012 after her mother’s death. When the 66-unit park went up for sale in 2021, she feared the community wouldn’t survive another private investor grabbing up the desirable land beneath their homes.

“The area that we live in is right by a lake and it's a really nice piece of property,” Knight said. “They would either bulldoze this whole thing down and put condos in, or they would keep it and skyrocket our rents up to where most people wouldn't have been able to afford it.”

Relocating to an RV park seemed like the only feasible alternative. As Knight weighed her housing options, the nonprofit Resident Ownership Capital (ROC USA) proposed a solution: the residents in the mobile community could form a cooperative to buy the park, allowing them to affordably own their own mobile homes and equal shares of the land underneath.

ROC USA received over $2 million in financing from Rural LISC in November 2021 to assist Quail Run, and another Washington mobile community, Royal Coachman in Royal City in purchasing their parks. As part of a master participation agreement, Rural LISC helped the purchase of senior participation in ROC USA’s loans to Washington and Minnesota manufactured home communities where 75% of households earn less than 80% AMI. When ROC USA partnered with Washington State’s Housing Finance Corporation to support the projects, funding 40% of the transaction, Rural LISC stepped in to fill in the gap.

“Given the importance of manufactured housing communities in rural America, this transaction is another opportunity for Rural LISC to partner with ROC USA to improve and preserve manufactured housing communities,” said Kathy Feingold, lending director for Rural LISC. “The subject financing can also engage Rural LISC’s network of community development partners to bring the ROC USA model to manufactured housing in their communities, which can lead to future lending opportunities.”

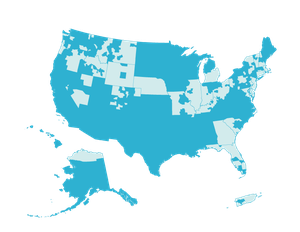

Since 2008, ROC USA has worked to scale, preserve, and improve affordable housing to build assets for low- and moderate-income families and expand economic opportunities to promote quality resident ownership in 321 resident-owned communities nationwide. Manufactured housing, which over 20 million Americans call home, are one of the few affordable housing options in the US, costing up to 50 percent less per square foot than conventional site-built homes. More than a third of mobile home residents own their homes but not the land that they’re on, meaning they must pay rent to the park, which is often owned by private equity firms who can raise costs as they please. Few states have laws protecting residents with the right of first refusal if their park goes up for sale, and moving the homes to another site is often too expensive, or risky for the structure of the house, to even consider.

What’s more, over 3 million people living in manufactured housing communities are located in rural parts of the U.S. where financing for affordable housing projects is harder to come by.

Since 2008, ROC USA has worked to scale, preserve, and improve affordable housing and expand economic opportunities to promote quality resident ownership in 321 resident-owned communities nationwide.

“A lot of partners, banks, insurance companies, other CDFIs state agencies aren't so focused on the rural, smaller communities like these, and these are important communities to assist,” said Michael Sloss, ROC USA Capital managing director. “The bigger institutions want to do the bigger transactions where there's a hundred units, not 40 units.”

Located near one of Washington’s major food processing and transportation hubs, the Moses Lake area where Quail Run is situated is key to the state’s regional agricultural economy. There’s a pressing need for affordable housing options for workers in those industries, many of whom are Latino farm laborers or truck drivers living on low incomes, Sloss explained.

When financing does become available for mobile home residents to purchase their parks, convincing them to join a co-op is often the next hurdle to overcome.

As Knight said of her neighbors at Quail Run, at first, “a lot of people, they didn't understand it, they were opposed to it.”

ROC USA staff met with Quail Run community members to dispel rumors, address their concerns, and guide them through the process.

Residents working to become a cooperative through ROC USA first create an interim board and then elect a board. As many of the residents who end up joining the association are volunteers and not professional real estate operators, the organization collaborates with technical assistant providers across the country to equip homeowners to manage funds, maintain compliance, mitigate lending risks, and promote board accountability to ensure they have the best opportunity to succeed. Technical assistance providers also work to encourage board members to sponsor social events to keep residents engaged.

Knight volunteered to join the board at Quail Run because no one else had. Other residents, most of whom are working families, were hard to get a hold of and unavailable to take on the necessary responsibilities, she explained.

“It's not that they don't want to, it's just that everybody's so busy trying to survive,” she said. “They're tired, they're taking care of their kids, they're doing all the stuff that working families do.”

Today, three years since Quail Run residents purchased their park, they are finding their footing with a new level of decision-making power and welcoming greater financial stability. Before becoming landowners, unwarranted rent increases could be made without any structural or community improvements, Knight explained.

Now, residents can vote, take surveys on rent increases, and invest profits into necessary repairs. They have created several reserve funds for community improvements including a sewer system project.

In just a few years as owners of their parks, Quail Run and Royal Coachman residents have already seen a range of upgrades. Royal Coachman has had the plumbing system repaired for about a quarter of residents and maintained landscaping in the park. Meanwhile, Quail Run has replaced a well pump and added new LED energy-efficient light posts throughout the community, which have reduced electricity costs and provided a new sense of safety at night, especially for older residents.

“If we wanted to put in a pool, we could decide to increase rents for three months and then put them back down,” Knight said. “We can decide if we want to improve something or not, we don't have to wait for some landowner. We're still working on infrastructure because the previous owner just did not do anything. It was left in our hands to fix it. We were subject to any kind of decisions.”

Owning the land beneath her trailer has made it possible for Knight to plan for personal home expenses, too.

“I'm really glad that ROC was able to help us and keep our rents under control and keep private investors off of us,” Knight said. “I don't have to spend so much money on bills. If anything needs fixing or improvements, I have the money for it.”